Introduction

Hollywood, FL, situated between Fort Lauderdale and Miami, is famous for its beautiful beach, iconic Broadwalk, and thriving arts and culture scene. With a strong tourism market and growing demand for vacation rentals, Hollywood offers several high-potential neighborhoods for investors. Here’s an analysis of the top zip codes, featuring gross yields, annual revenues, Zillow home values, and insights into each area.

33021: Emerald Hills & Hillcrest

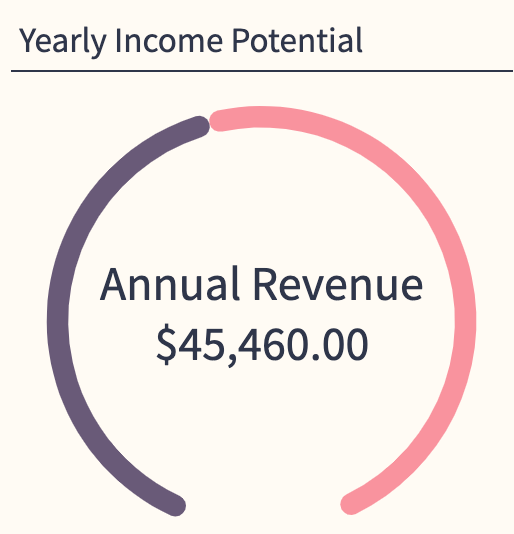

- Gross Yield: 10%

- Annual Revenue: $45,460

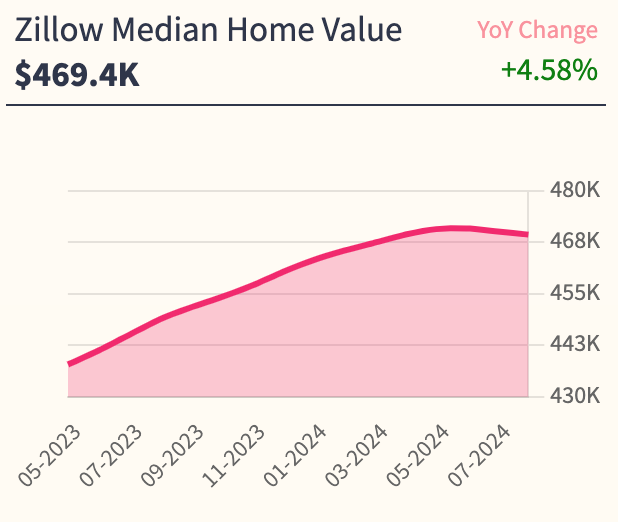

- Zillow Home Value: $472.0K

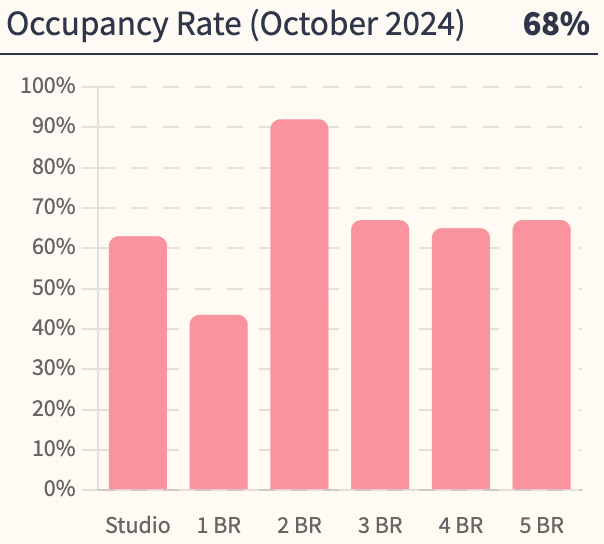

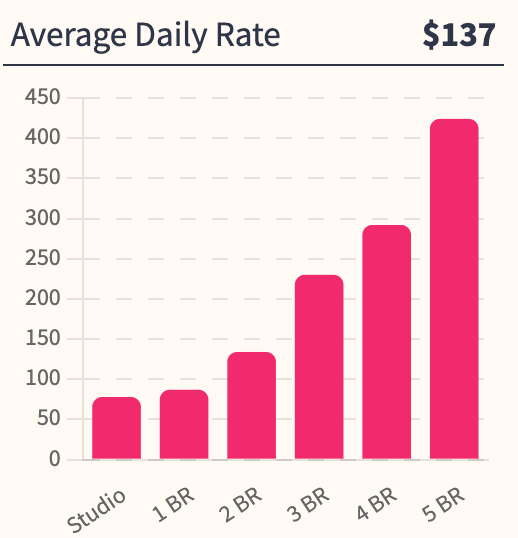

Zip code 33021 covers neighborhoods like Emerald Hills and Hillcrest, both known for their family-friendly environments and proximity to shopping centers and schools. With a gross yield of 10%, the area offers significant rental income potential, and an annual revenue of $45,460 reflects the steady demand from both tourists and business travelers. The Zillow home value of $472.0K indicates a robust real estate market, making this area attractive for investors seeking strong, consistent returns.

33026: Pembroke Lakes & Chapel Trail

- Gross Yield: 9%

- Annual Revenue: $41,001

- Zillow Home Value: $468.7K

This zip code extends into parts of Pembroke Lakes and Chapel Trail, areas that blend residential comfort with access to parks and amenities. With a gross yield of 9%, investors can achieve solid returns in a quieter, suburban setting. The annual revenue of $41,001 reflects the area’s appeal to families and long-term visitors. Home values in the area average $468.7K, and with limited full-time listings, there’s potential for short-term rentals to perform well, given the less saturated market.

33019: Hollywood Beach & North Beach

- Gross Yield: 7%

- Annual Revenue: $40,432

- Zillow Home Value: $560.3K

Hollywood Beach and North Beach fall within zip code 33019, one of the most popular tourist destinations in Hollywood. The area features attractions like the Hollywood Beach Broadwalk, luxury hotels, and vibrant nightlife, driving strong visitor numbers. With a gross yield of 7% and annual revenue of $40,432, it remains a lucrative area despite higher home prices, averaging $560.3K. Investors here can expect high occupancy rates, especially during peak vacation seasons, making it an excellent choice for those seeking premium properties with consistent demand.