If you're searching for the best Airbnb markets in California, you're probably not planning a vacation. You're trying to answer a money question: where can a short-term rental (STR) actually produce enough revenue to justify the buy price after real operating costs?

This guide gives you an investor-first answer using Chalet's California market dataset (January 2026 snapshot). We've ranked everything by gross yield (annual revenue / home price), so you can start with the markets where the math looks most attractive and then drill down to a specific neighborhood and address.

Want to explore beyond this top 8? Analyze markets for free with our dashboards.

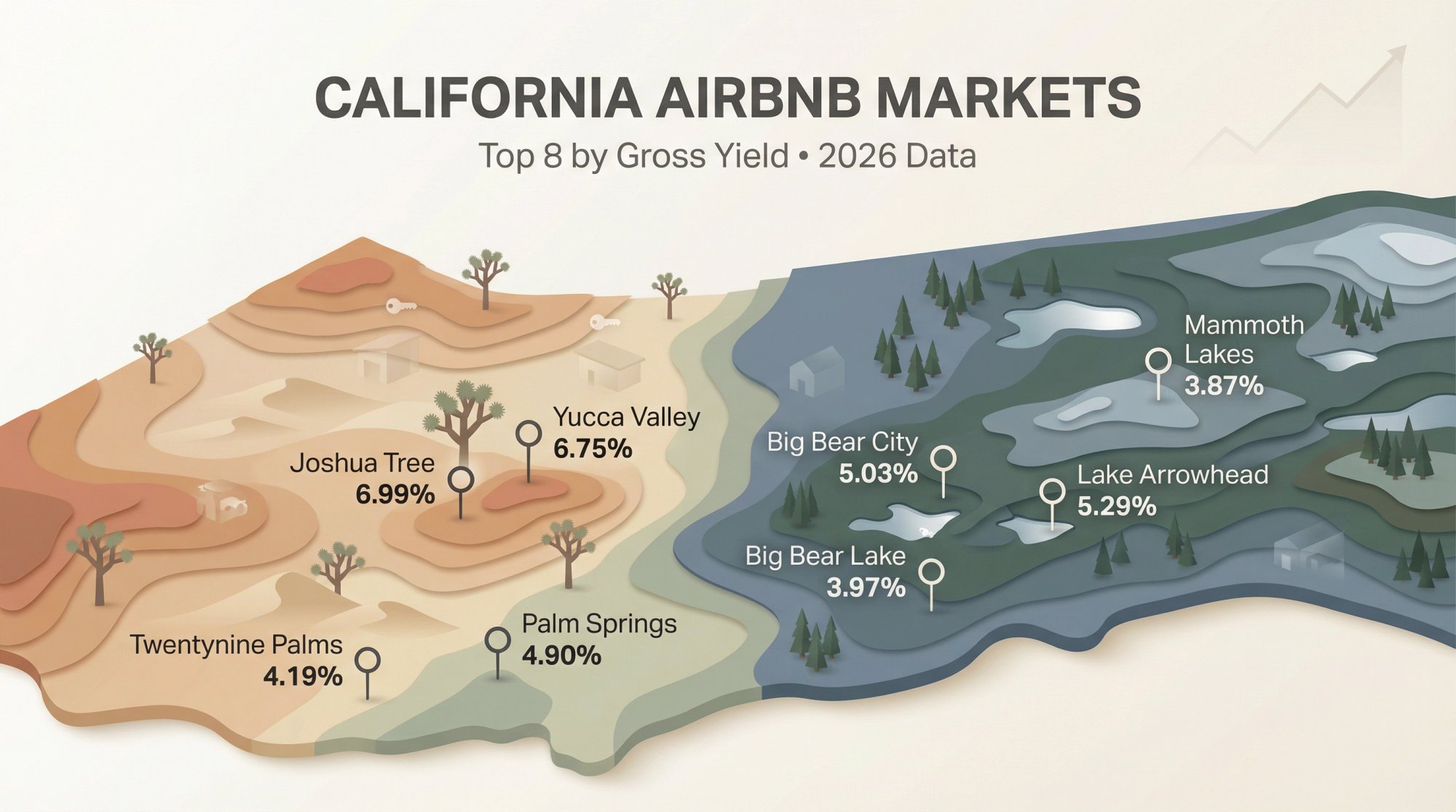

Top 8 California Airbnb Markets Ranked by Gross Yield

Highest Gross Yield (Best Revenue vs. Price Balance):

Joshua Tree pulls 6.99% gross yield with a 4.20% cap rate. Average home price sits at $339,069.86 generating $23,710.95 in annual revenue.

Yucca Valley follows closely at 6.75% gross yield, 4.05% cap rate, $355,896.12 average price, and $24,012.95 annual revenue.

Highest Annual Revenue (Strong Top-Line, Higher Buy-In):

Mammoth Lakes leads with $31,016.50 annual revenue on an $800,945.82 average price (gross yield 3.87%)

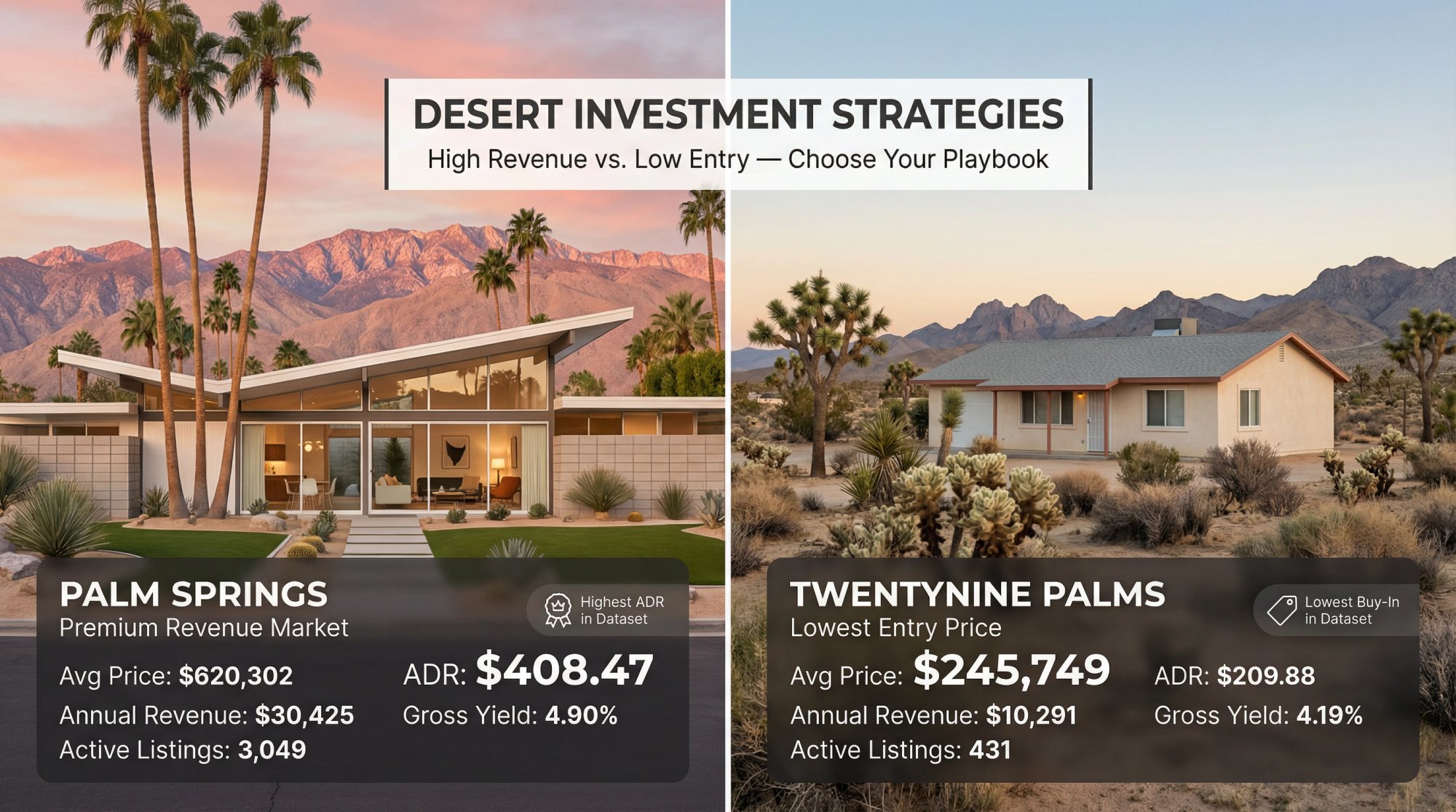

Palm Springs comes in at $30,425.00 annual revenue on $620,302.46 average price (gross yield 4.90%)

Lowest Average Buy-In (Budget-Friendly Entry Points):

Twentynine Palms offers the lowest barrier at $245,748.95 average price (gross yield 4.19%)

Joshua Tree remains accessible at $339,069.86 average price (gross yield 6.99%)

Highest Occupancy in This Dataset:

Joshua Tree and Mammoth Lakes both hit 44% occupancy

Competition Check (Most Active Listings):

Palm Springs leads with 3,049 active listings

Big Bear Lake has 2,444 listings

Mammoth Lakes shows 2,311 listings

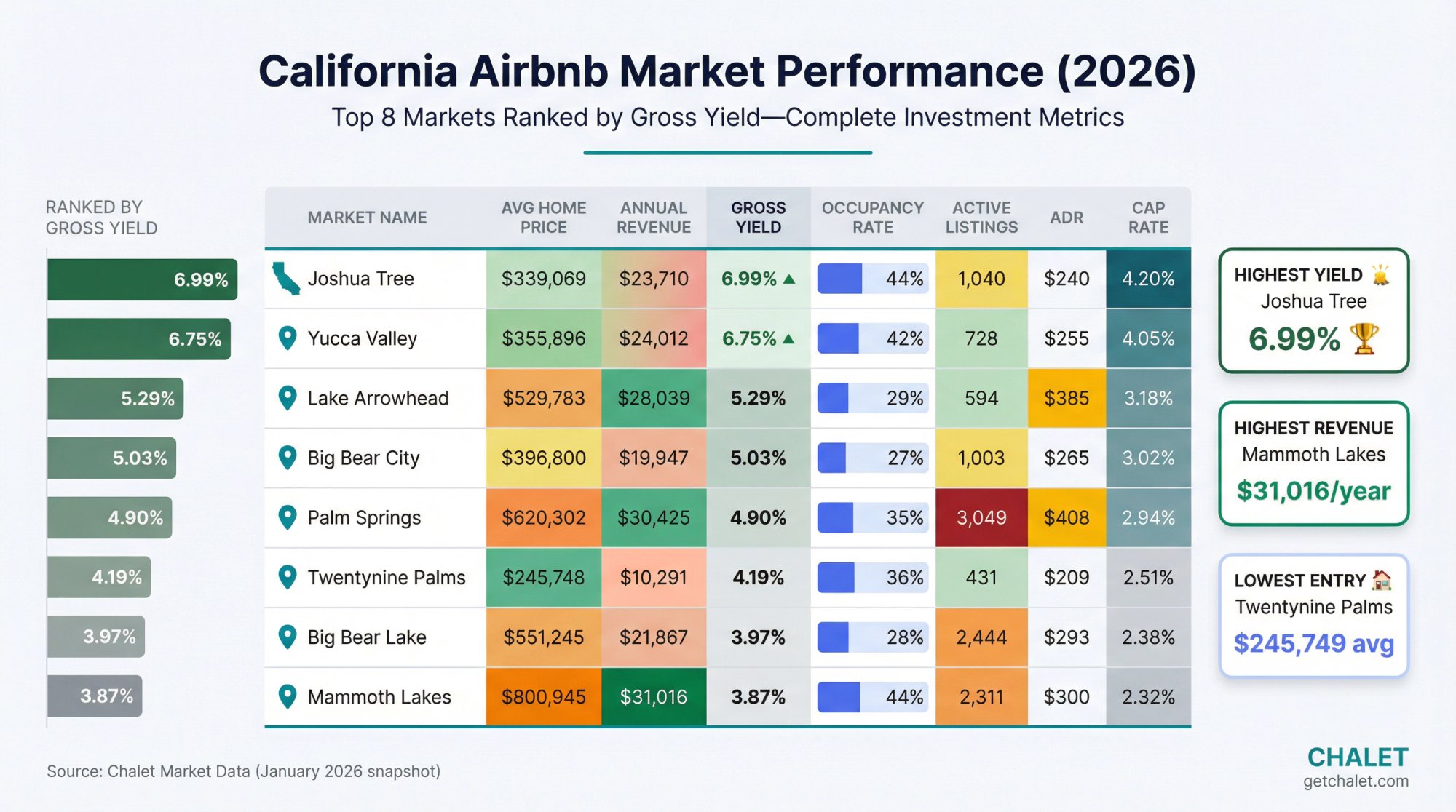

California Airbnb Market Data: Complete Performance Table

Source: Chalet

| Market | Avg Home Price | Active Listings | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Dashboard |

|---|---|---|---|---|---|---|---|---|

| Joshua Tree | $339,069.86 | 1,040 | $240.92 | 44% | $23,710.95 | 6.99% | 4.20% | View Dashboard |

| Yucca Valley | $355,896.12 | 728 | $255.14 | 42% | $24,012.95 | 6.75% | 4.05% | View Dashboard |

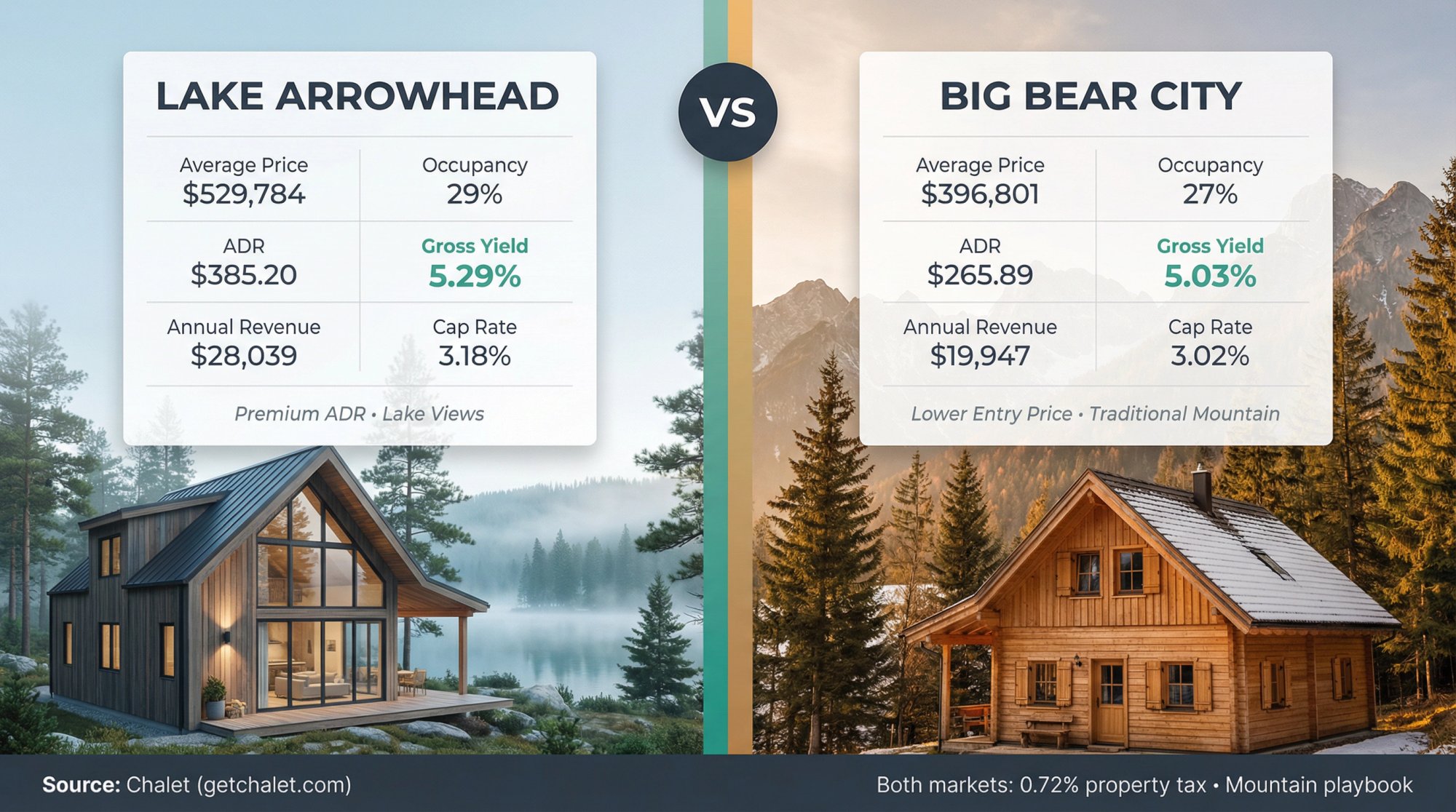

| Lake Arrowhead | $529,783.77 | 594 | $385.20 | 29% | $28,039.26 | 5.29% | 3.18% | View Dashboard |

| Big Bear City | $396,800.91 | 1,003 | $265.89 | 27% | $19,947.33 | 5.03% | 3.02% | View Dashboard |

| Palm Springs | $620,302.46 | 3,049 | $408.47 | 35% | $30,425.00 | 4.90% | 2.94% | View Dashboard |

| Twentynine Palms | $245,748.95 | 431 | $209.88 | 36% | $10,291.00 | 4.19% | 2.51% | View Dashboard |

| Big Bear Lake | $551,245.93 | 2,444 | $293.26 | 28% | $21,867.00 | 3.97% | 2.38% | View Dashboard |

| Mammoth Lakes | $800,945.82 | 2,311 | $300.15 | 44% | $31,016.50 | 3.87% | 2.32% | View Dashboard |

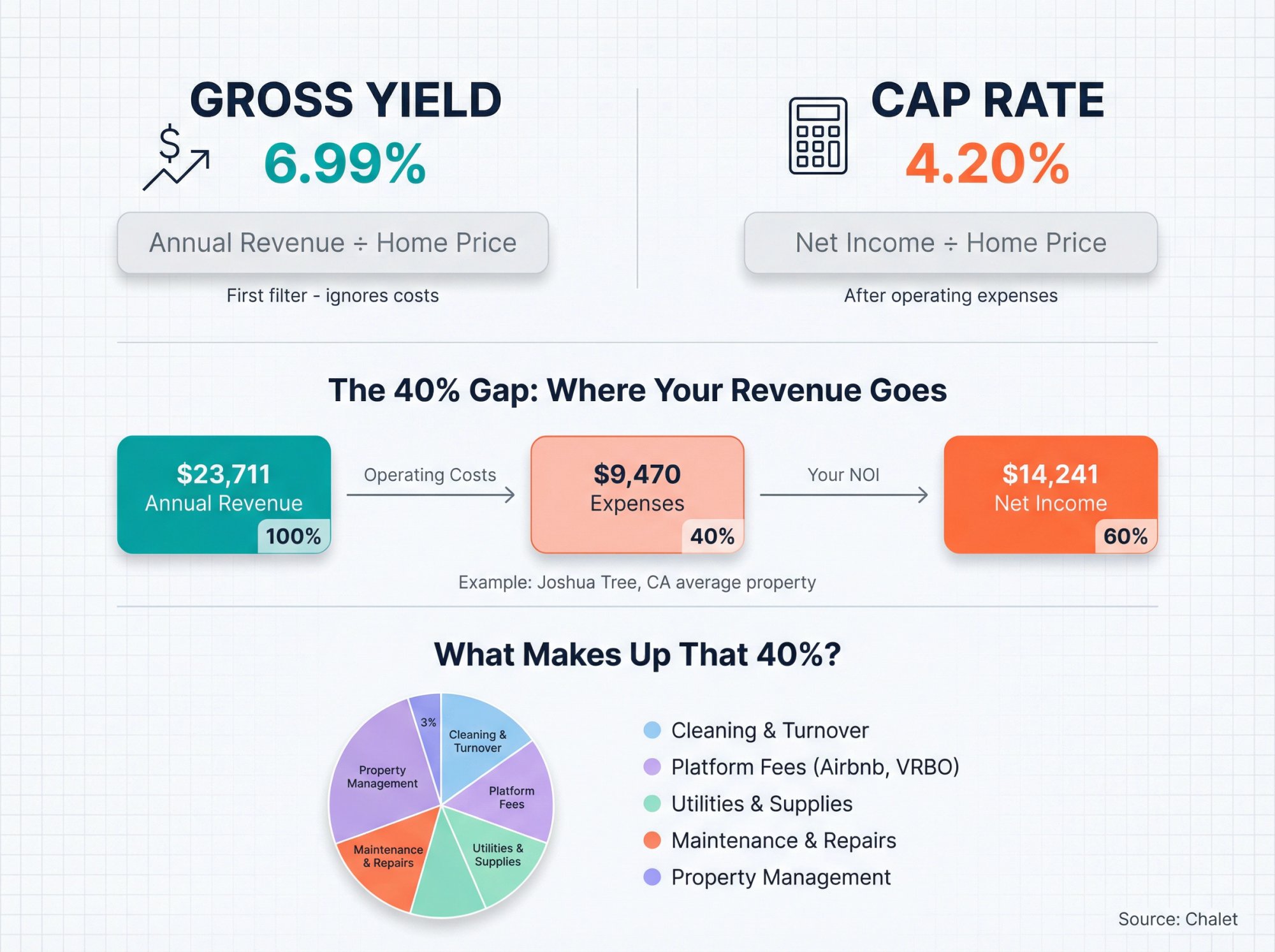

What Do Gross Yield and Cap Rate Mean for Airbnb Investors?

You'll see two return metrics in the table above. Both matter, but they answer different questions. Understanding Airbnb income starts with knowing what these metrics reveal.

Gross Yield: Revenue Divided by Property Price

This tells you how much top-line revenue a market produces relative to the buy price. It's a fast way to rank markets, but it ignores operating costs entirely. Think of it as a first filter, not a final answer. For a deeper look at markets with high cap rates, see our dedicated analysis.

Cap Rate: Net Operating Income Divided by Price

This gets closer to reality by factoring in typical operating expenses. It shows your unlevered return before financing. Still not the same as your cash-on-cash return (because your mortgage, reserves, and specific setup all change the equation), but much more useful than gross yield alone.

How to Calculate Operating Expenses from Yield and Cap Rate

Because you have both metrics, you can infer how much operating expense is baked into these estimates. Looking at this dataset, the gap between gross yield and cap rate implies roughly 40% of gross revenue goes to operating expenses. That includes cleaning, turns, supplies, utilities, maintenance, platform fees, management, and everything else that comes with running a rental.

Important: That 40% is what the data implies, not a guarantee. Your actual expenses will depend on your specific property, management approach, and local costs.

Here's what that looks like in actual dollars:

| Market | Annual Revenue | Implied NOI | Implied Operating Expenses | Implied Expense Ratio |

|---|---|---|---|---|

| Joshua Tree | $23,710.95 | ~$14,241 | ~$9,470 | ~39.9% |

| Yucca Valley | $24,012.95 | ~$14,414 | ~$9,599 | ~40.0% |

| Lake Arrowhead | $28,039.26 | ~$16,847 | ~$11,192 | ~39.9% |

| Big Bear City | $19,947.33 | ~$11,983 | ~$7,964 | ~39.9% |

| Palm Springs | $30,425.00 | ~$18,237 | ~$12,188 | ~40.1% |

| Twentynine Palms | $10,291.00 | ~$6,168 | ~$4,123 | ~40.1% |

| Big Bear Lake | $21,867.00 | ~$13,120 | ~$8,747 | ~40.0% |

| Mammoth Lakes | $31,016.50 | ~$18,582 | ~$12,435 | ~40.1% |

Source: Chalet – derived from cap rate x price and annual revenue

If you're a first-time STR investor, this gives you a sane starting point for expense assumptions. You'll still need to verify address-level costs like insurance, utilities, snow service, pool service, trash, and repairs.

Ready to run the numbers on a specific property? Use our ROI and DSCR calculator for free.

How to Choose the Best California Airbnb Market for Your Investment Goals

Most people pick a market like they're choosing a vacation spot. Investors should pick it like an operator. If you're wondering are Airbnbs profitable, the answer depends entirely on which framework you use.

Step 1: Decide What You're Optimizing For

Pick your "one thing" first. Here are common goals and which markets naturally fit them:

→ Maximize Yield: Joshua Tree, Yucca Valley

→ Maximize Annual Revenue: Mammoth Lakes, Palm Springs

→ Minimize Buy-In Price: Twentynine Palms, Joshua Tree

→ Shop the Widest Inventory (for faster deal execution): Palm Springs, Big Bear Lake, Mammoth Lakes

→ Avoid Negative YoY Home Value Change: Mammoth Lakes is the only positive YoY in this dataset (+0.89%)

Step 2: Choose Your Operating Style: Desert vs. Mountain

This top 8 clusters into two distinct playbooks:

Desert Getaway Playbook: Joshua Tree, Yucca Valley, Palm Springs, Twentynine Palms

These tend to be about design, photos, guest experience, and weekend demand patterns. Lower maintenance complexity overall. For similar desert market analysis, see our best Airbnb markets in Arizona guide.

Mountain/Cabin/Snow Playbook: Lake Arrowhead, Big Bear City, Big Bear Lake, Mammoth Lakes

These tend to involve seasonality, maintenance, weatherproofing, and higher operational complexity. Snow removal, heating costs, and road access become real considerations. Our best Airbnb markets for ski tourism guide covers similar dynamics.

Step 3: Use Active Listings as a Competition Check

Higher active listings can mean:

-

More demand and more supply

-

More comps to study

-

More need to differentiate your product through amenities, layout, design, and reviews

It's not inherently good or bad. It's just a reality check on how crowded the market is. Markets with over 2,000 listings require sharper execution. See our analysis of markets with more than 2,000 listings for deeper insights.

Step 4: Use Year-Over-Year Price Change as a Risk Signal

A negative YoY change can be two things:

-

A better entry price window (good for your returns)

-

A sign the market has cooled (requires caution)

You don't need to predict appreciation. You need to avoid overpaying and avoid markets where regulations or demand could break your model.

Market-by-Market Analysis: Best Airbnb Markets in California

Below, each market gets a clean snapshot, what makes it work, what to watch, and who it's best for.

Joshua Tree, CA: Highest Gross Yield in California (6.99%)

Why It's on Top: Joshua Tree combines a relatively lower average home price ($339,069.86) with strong estimated annual revenue ($23,710.95) and the joint-highest occupancy (44%) in this dataset. That drives the highest gross yield (6.99%) and cap rate (4.20%).

The Numbers:

| Metric | Value |

|---|---|

| Average Price | $339,069.86 |

| YoY Home Value Change | -10.82% |

| Active Listings | 1,040 |

| ADR | $240.92 |

| Occupancy | 44% |

| Annual Revenue | $23,710.95 |

| Gross Yield / Cap Rate | 6.99% / 4.20% |

| Property Tax | 0.72% |

What to Watch:

That YoY price move (-10.82%) is significant. It can help entry pricing, but it's also a loud "do your comps carefully" flag. And 1,040 active listings means you're not alone out there. Assume you'll need to differentiate.

Best For:

-

First-time buyers who want yield with a moderate buy-in

-

Portfolio builders who already understand design/ops and want a desert anchor property

Your Next Step: See the Joshua Tree dashboard or connect with an Airbnb-friendly agent

Yucca Valley, CA: Second-Best Airbnb Yield in California (6.75%)

Why It Ranks: Similar yield math to Joshua Tree. Solid annual revenue ($24,012.95) on a mid-$300k average price ($355,896.12) and strong occupancy (42%) produces 6.75% gross yield.

The Numbers:

| Metric | Value |

|---|---|

| Average Price | $355,896.12 |

| YoY Home Value Change | -4.94% |

| Active Listings | 728 |

| ADR | $255.14 |

| Occupancy | 42% |

| Annual Revenue | $24,012.95 |

| Gross Yield / Cap Rate | 6.75% / 4.05% |

| Property Tax | 0.72% |

What to Watch:

728 active listings is still competitive, but not as saturated as some bigger resort markets in this list. Just remember: a good market isn't the same as a good deal. Underwriting still matters at the property level.

Best For:

-

First-time buyers who want strong yield but want a different inventory pool than Joshua Tree

-

1031 exchange buyers who want a cleaner math story without the heaviest listing count

Your Next Step: Explore the Yucca Valley dashboard or run ROI/DSCR on a specific address

Lake Arrowhead, CA: Best California Mountain Market for High ADR

Why It Ranks: High ADR ($385.20, second-highest in this dataset) helps offset lower occupancy (29%) and a higher buy price ($529,783.77), landing at 5.29% gross yield.

The Numbers:

| Metric | Value |

|---|---|

| Average Price | $529,783.77 |

| YoY Home Value Change | -7.41% |

| Active Listings | 594 |

| ADR | $385.20 |

| Occupancy | 29% |

| Annual Revenue | $28,039.26 |

| Gross Yield / Cap Rate | 5.29% / 3.18% |

| Property Tax | 0.72% |

What to Watch:

The occupancy is low relative to the desert markets. That often means seasonality and weekend-heavy booking patterns. You can still win here, just don't underwrite like it's a city hotel. And the negative YoY move (-7.41%) means price discipline matters. Understanding average Airbnb occupancy rates by city helps set realistic expectations.

Best For:

-

Operators who understand seasonality and want higher nightly rates

-

Portfolio builders adding a mountain product type to diversify

Your Next Step: Check the Lake Arrowhead dashboard or line up your vendor stack early

Big Bear City, CA: Affordable Mountain Airbnb Market with 5.03% Yield

Why It Ranks: It's one of the lower-priced mountain entries ($396,800.91) with decent revenue ($19,947.33), producing 5.03% gross yield.

The Numbers:

| Metric | Value |

|---|---|

| Average Price | $396,800.91 |

| YoY Home Value Change | -6.19% |

| Active Listings | 1,003 |

| ADR | $265.89 |

| Occupancy | 27% |

| Annual Revenue | $19,947.33 |

| Gross Yield / Cap Rate | 5.03% / 3.02% |

| Property Tax | 0.72% |

What to Watch:

Lowest occupancy in this list (27%) means your calendar can be spiky. Your pricing and ops systems matter more here than in steadier markets. Plus, 1,003 active listings signals real competition.

Best For:

-

Buyers who want a mountain market but need a lower average price than the premium resort towns

-

Hands-on hosts who can actively manage pricing and guest experience

Your Next Step: View the Big Bear City dashboard or browse Airbnb rentals for sale

Palm Springs, CA: Highest Airbnb Revenue Market in California ($30,425/Year)

Why It Ranks: Palm Springs has the highest ADR in the list ($408.47) and strong annual revenue ($30,425.00), but the buy price is also high ($620,302.46) and active listings are the heaviest (3,049). That pulls gross yield to 4.90%.

The Numbers:

| Metric | Value |

|---|---|

| Average Price | $620,302.46 |

| YoY Home Value Change | -5.45% |

| Active Listings | 3,049 |

| ADR | $408.47 |

| Occupancy | 35% |

| Annual Revenue | $30,425.00 |

| Gross Yield / Cap Rate | 4.90% / 2.94% |

| Property Tax | 0.86% |

What to Watch:

3,049 active listings means you're competing with a lot of hosts. The winners tend to be the ones who build a real product (layout, amenities, brand, reviews), not just "a house on Airbnb." Plus, higher property tax rate (0.86%) matters when you model true net income. For markets with low property tax, consider other California options.

Best For:

-

Operators who can differentiate through design, amenities, marketing, and pricing discipline

-

1031 exchange investors who value large inventory and deal flow, but still need a sharp filter

Your Next Step: Explore the Palm Springs dashboard or connect with an Airbnb-friendly agent

Twentynine Palms, CA: Lowest-Cost California Airbnb Market ($245,749 Average)

Why It Ranks: It's the lowest average home price in the list ($245,748.95). Even with the lowest annual revenue ($10,291.00), the entry price keeps gross yield at 4.19%.

The Numbers:

| Metric | Value |

|---|---|

| Average Price | $245,748.95 |

| YoY Home Value Change | -4.92% |

| Active Listings | 431 |

| ADR | $209.88 |

| Occupancy | 36% |

| Annual Revenue | $10,291.00 |

| Gross Yield / Cap Rate | 4.19% / 2.51% |

| Property Tax | 0.72% |

What to Watch:

The revenue number is low. This isn't a "set it and forget it" market if your mortgage payment is large relative to your buy price. Lower active listings (431) can mean less direct competition, but also fewer comps and potentially more variance in performance. For budget-friendly Airbnb markets with similar entry points, explore our full guide.

Best For:

-

First-time buyers who want the lowest entry point and can be selective on the deal

-

Buyers comfortable doing deeper comp work (because you can't just copy the average and expect it to hold)

Your Next Step: Connect with a local Twentynine Palms agent or stress-test your deal with ROI/DSCR

Big Bear Lake, CA: Popular Resort Market with 3.97% Yield

Why It Ranks: Decent annual revenue ($21,867.00) on a higher price ($551,245.93) and very high active listings (2,444) produces lower gross yield (3.97%). It's a classic "popular resort, harder math" profile.

The Numbers:

| Metric | Value |

|---|---|

| Average Price | $551,245.93 |

| YoY Home Value Change | -6.93% |

| Active Listings | 2,444 |

| ADR | $293.26 |

| Occupancy | 28% |

| Annual Revenue | $21,867.00 |

| Gross Yield / Cap Rate | 3.97% / 2.38% |

| Property Tax | 0.72% |

What to Watch:

Big supply (2,444 active listings) means pricing pressure is real. And a lower cap rate (2.38%) means you can't be sloppy on expenses or setup budget. Every dollar counts here.

Best For:

-

Experienced operators who can build a differentiated listing and manage costs tightly

-

1031 exchange investors who want lots of inventory to close quickly, but only if they have a clear buy box

Your Next Step: View the Big Bear Lake dashboard or build your vendor stack before you close

Mammoth Lakes, CA: Highest Annual Airbnb Revenue in California ($31,016/Year)

Why It Ranks: Mammoth Lakes has the highest average home price by far ($800,945.82). It also has the highest annual revenue ($31,016.50) and the joint-highest occupancy (44%). It's a "premium market" profile: strong top-line, tougher yield math.

The Numbers:

| Metric | Value |

|---|---|

| Average Price | $800,945.82 |

| YoY Home Value Change | +0.89% |

| Active Listings | 2,311 |

| ADR | $300.15 |

| Occupancy | 44% |

| Annual Revenue | $31,016.50 |

| Gross Yield / Cap Rate | 3.87% / 2.32% |

| Property Tax | 0.68% |

What to Watch:

The buy price creates the main risk. You can have great revenue and still have thin returns if you overpay or overspend on setup. Cap rate is the lowest in the list (2.32%). You need a clear strategy: premium property, premium ops, premium reviews.

The one bright spot? It's the only market in this dataset with positive YoY home value change (+0.89%). For other high annual revenue markets, see our comprehensive comparison.

Best For:

-

Portfolio builders who can afford a higher buy price and want a premium destination product

-

Operators who can execute high standards consistently (guest experience matters more here than almost anywhere else)

Your Next Step: Explore the Mammoth Lakes dashboard or browse properties for sale

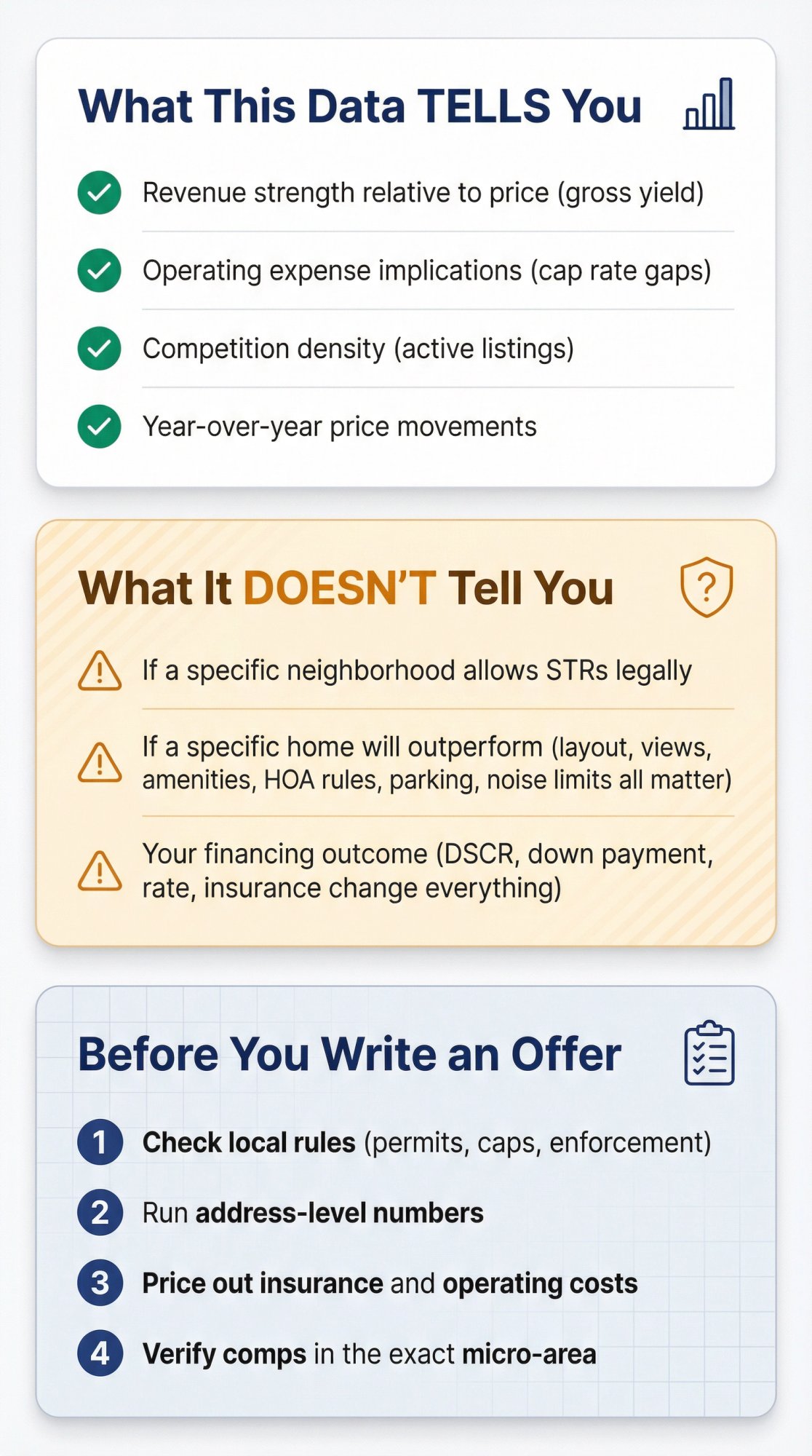

What This California Market Data Tells You (and What It Doesn't)

This ranking is a market filter, not a deal guarantee.

It tells you:

-

Where revenue appears strong relative to price (gross yield)

-

Where expenses (as implied by cap rate) leave more or less room

-

Where competition (active listings) looks heavier or lighter

-

How prices are moving year-over-year

It does not tell you:

-

If a specific neighborhood allows STRs legally

-

If a specific home will outperform (layout, views, amenities, HOA rules, parking, noise limits all matter)

-

Your financing outcome (your DSCR, down payment, rate, and insurance change everything)

Before you write an offer, you should always:

① Check local rules (permits, caps, enforcement). Start with California rental regulations.

② Run address-level numbers

③ Price out insurance and operating costs

④ Verify comps in the exact micro-area

How Chalet Helps You Move From Research to Property Purchase

At Chalet, we built everything an Airbnb investor needs in one place. No subscriptions. No paywalls. Here's how we help:

Free Market Analytics

Our market dashboards show ADR, occupancy, revenue trends, and comp data across California and beyond. All the markets in this guide have dedicated dashboards you can explore right now. We've been comparing the best Airbnb analytics tools so you don't have to.

ROI and DSCR Calculator

When you find a property, our free calculator helps you stress-test the deal. Plug in an address and get estimated returns, expense assumptions, and DSCR projections. Learn why it's considered the best Airbnb calculator available.

Vetted Vendor Network

Need an STR-friendly agent? DSCR lender? Property manager? Insurance provider? Our vendor directory connects you with professionals who actually specialize in short-term rentals.

Property Listings

Ready to shop? Browse Airbnbs for sale and find properties already set up for vacation rental use.

The Chalet flow: Analyze markets → Run ROI/DSCR → Meet an agent → Set up operations

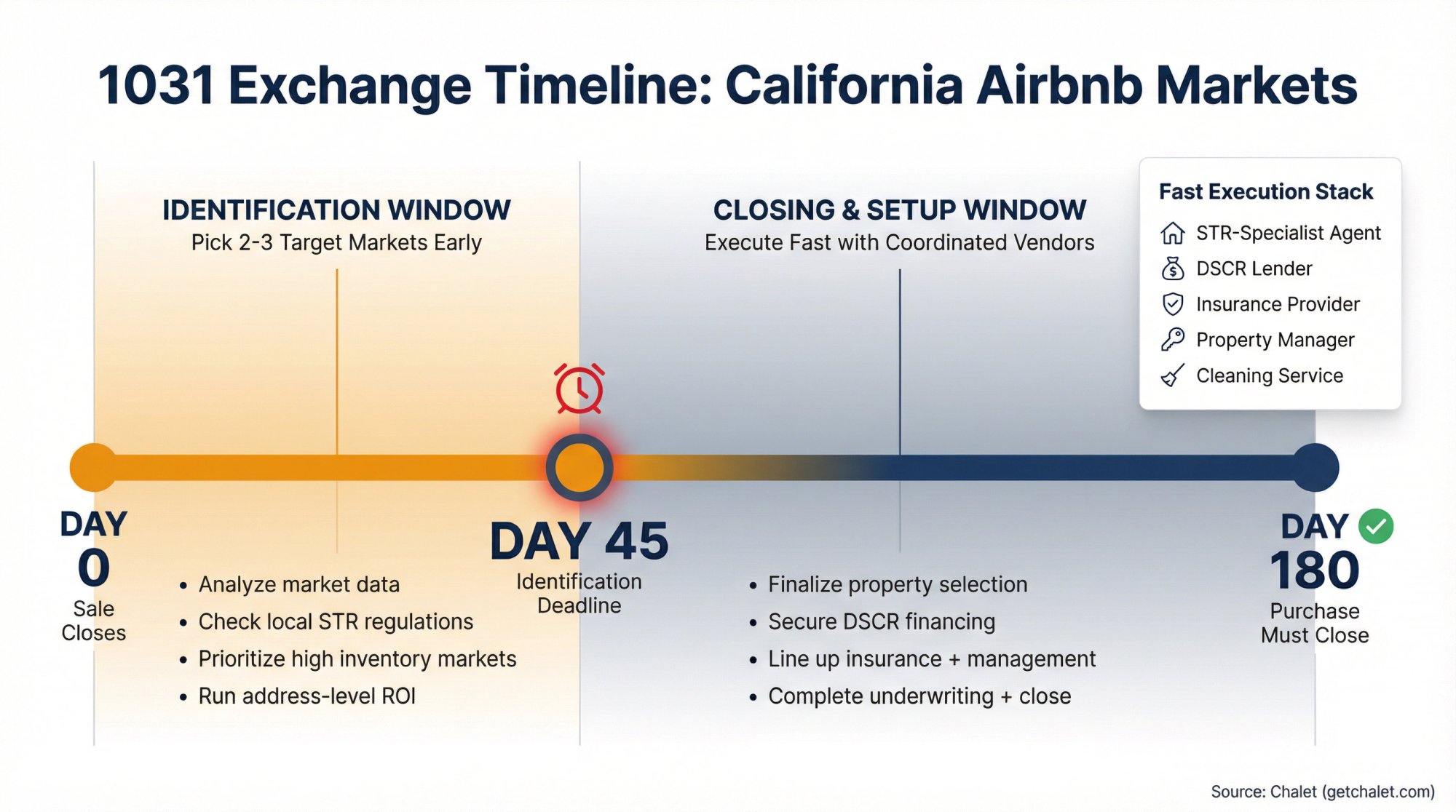

How to Use This List for 1031 Exchange into California Airbnb Markets

If you're doing a 1031 exchange, you don't have time to browse markets casually. You need a tight funnel:

Start with 2-3 markets from this top 8 that fit your budget. Don't try to analyze everything. Pick your targets early.

Prioritize inventory if speed matters. Higher active listings (Palm Springs, Big Bear Lake, Mammoth Lakes) mean more options to identify within your 45-day window.

Then immediately move to address-level underwriting and local rule checks. The market data is just the starting point.

Fast Execution Stack:

Get your agent + lender + insurance + manager/cleaning lined up before you identify. Then: property selection → underwriting → offer → setup.

Avoid these 5 common mistakes in 1031 exchanges and set yourself up for success.

You can build that stack now: Set up your STR operations

For California specifically, explore our 1031 exchange California resources.

Best California Airbnb Markets: Quick Reference Summary

If you want the simplest "start here" answer from this dataset:

| Priority | Best Markets |

|---|---|

| Best Yield-Focused Picks | Joshua Tree, Yucca Valley |

| Best Revenue-Focused Picks | Mammoth Lakes, Palm Springs |

| Best Low Buy-In Option | Twentynine Palms |

| Best "Mountain ADR" Profile | Lake Arrowhead |

| Most Competition-Heavy Markets (bring a differentiation plan) | Palm Springs, Big Bear Lake, Mammoth Lakes |

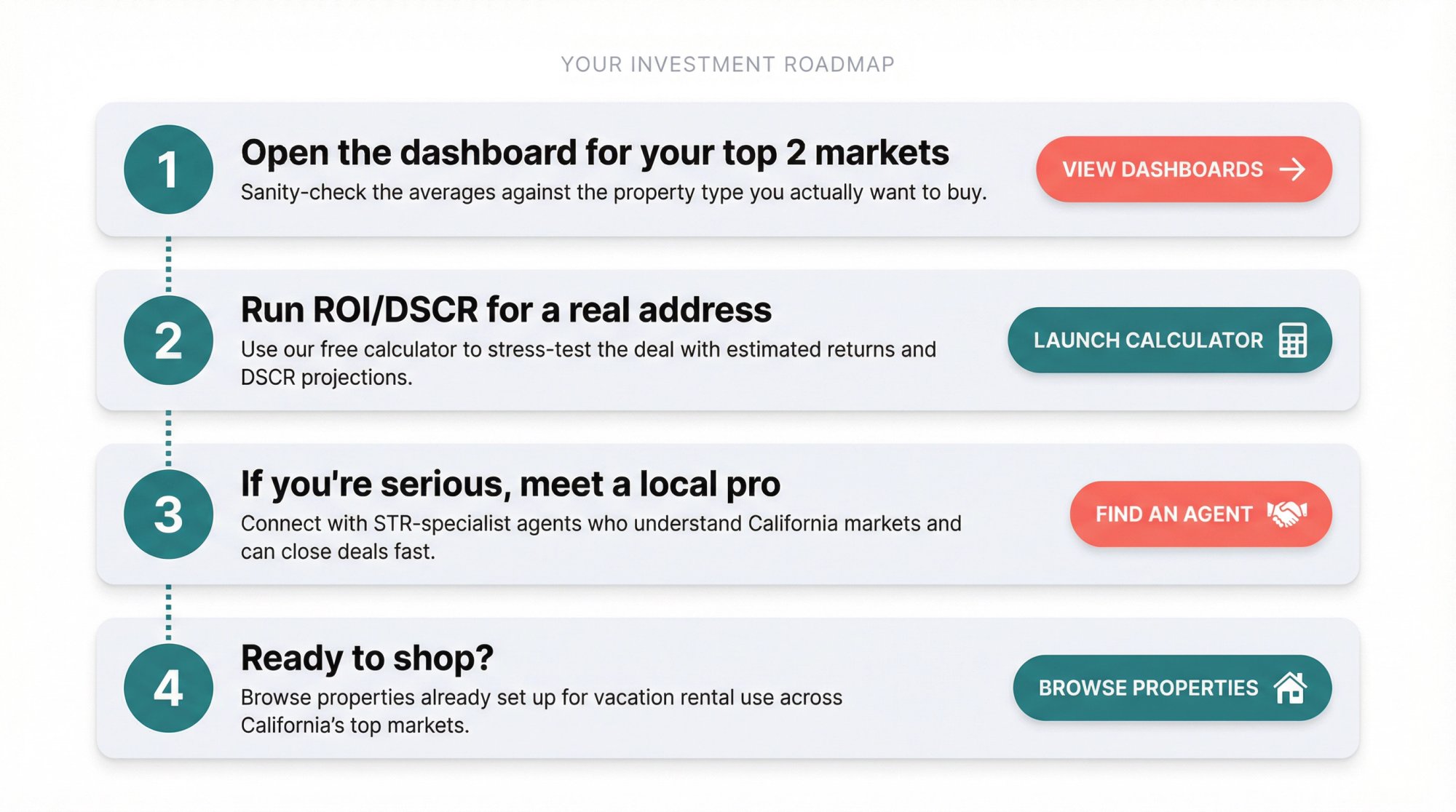

Your Next Steps to Invest in California Airbnb Markets

① Open the dashboard for your top 2 markets (links throughout this guide) and sanity-check the averages against the property type you actually want to buy.

② Run ROI/DSCR for a real address → Airbnb Calculator

③ If you're serious, meet a local pro → Find an Airbnb-Friendly Agent

④ Ready to shop? → Browse Airbnbs for Sale

Frequently Asked Questions

What is the most profitable Airbnb market in California?

Based on gross yield (annual revenue divided by home price), Joshua Tree currently leads California markets at 6.99% gross yield with a 4.20% cap rate. But "most profitable" depends on your definition. If you're optimizing for total annual revenue, Mammoth Lakes produces $31,016.50 per year. If you want the lowest buy-in price, Twentynine Palms averages just $245,748.95.

How much can you make on an Airbnb in California?

In the top 8 California markets we analyzed, annual revenue ranges from $10,291 (Twentynine Palms) to $31,016.50 (Mammoth Lakes). Most markets in this dataset generate between $20,000 and $30,000 in estimated annual revenue. Your actual income will depend on your specific property, pricing strategy, and occupancy. Use our Airbnb income estimator for property-specific projections.

What occupancy rate should I expect for a California Airbnb?

Occupancy rates in these top California markets range from 27% (Big Bear City) to 44% (Joshua Tree and Mammoth Lakes). Desert markets generally show higher occupancy than mountain markets, which tend to have more seasonal demand patterns. Keep in mind these are market averages. Individual properties can outperform or underperform based on location, amenities, and reviews.

Is Palm Springs a good Airbnb investment?

Palm Springs offers the highest ADR in this dataset ($408.47) and strong annual revenue ($30,425). The trade-off? It's also the most competitive market with 3,049 active listings and a higher property tax rate (0.86%). Investors who succeed here typically differentiate through design, amenities, and marketing. It's not a market for passive operators. View the Palm Springs analytics for current data.

What's the difference between gross yield and cap rate?

Gross yield is annual revenue divided by home price. It's a quick comparison tool but ignores operating costs. Cap rate is net operating income (after expenses) divided by price. In this dataset, the gap suggests roughly 40% of revenue goes to operating expenses. Always use cap rate for more realistic return estimates.

Are mountain or desert Airbnbs better investments in California?

It depends on your operating style. Desert markets (Joshua Tree, Yucca Valley, Palm Springs, Twentynine Palms) tend to have higher occupancy, simpler operations, and lower maintenance. Mountain markets (Lake Arrowhead, Big Bear City, Big Bear Lake, Mammoth Lakes) offer higher ADRs but come with seasonality, weatherproofing costs, and more operational complexity. Neither is objectively "better." See our best Airbnb markets in the mountains and best Airbnb markets in the west for more comparisons.

How do I check if short-term rentals are legal in a California city?

Always verify local regulations before buying. Some California cities have permit requirements, occupancy limits, or outright bans on STRs. Check with the city planning department or use Chalet's California rental regulations guide for initial guidance, then confirm directly with local authorities.

What expenses should I budget for a California Airbnb?

Based on the implied operating costs in this dataset, plan for roughly 40% of gross revenue going to expenses. This typically includes: cleaning and turnover costs, utilities, supplies, maintenance and repairs, platform fees (Airbnb, VRBO), property management (if used), insurance, and landscaping or pool service. Mountain properties often have additional costs like snow removal and heating.

Should I self-manage or hire a property manager?

Self-managing saves the 20-30% management fee but requires significant time. Most investors in competitive markets like Palm Springs or Big Bear Lake eventually hire managers to maintain 5-star reviews. First-time buyers often start self-managing to learn the business, then transition to professional management as they scale. Use Chalet's vendor directory to compare property managers in your target market. For more guidance, read our guide on comparing different property management styles.

How do I finance an Airbnb investment property?

Most STR investors use either conventional investment property loans or DSCR loans. DSCR loans are popular because they qualify you based on the property's projected rental income rather than your personal W-2 income. This matters if you're self-employed or already have multiple properties. Read our complete guide on building an Airbnb empire with DSCR loans and run your numbers with Chalet's ROI/DSCR calculator to see what works for your situation.

What about mid-term rentals in California?

If you want to explore 30+ day stays as an alternative or supplement to short-term rentals, California has strong mid-term rental potential. Check out our guide to best mid-term rental markets in California for markets that work well for traveling nurses, corporate relocations, and extended stays.

Data Currency Note

All prices and performance metrics in this article reflect Chalet's January 2026 dataset (including the Zillow YoY change and average home price fields shown above). Short-term rental performance and home values move. Treat these numbers as a starting point, then validate at the neighborhood and address level before you buy.

Not legal, tax, or financial advice. Always confirm local short-term rental rules and consult the appropriate professionals for your situation.